Why are companies keeping their cash in the bank when purchasing new equipment?

Economic uncertainty and increasing pressure on companies to adapt to rapidly changing market conditions make the future difficult to predict. Many companies are turning to asset finance to secure the equipment and technology they need to stay competitive. Here we'll explore why we are seeing more and more companies turning to asset finance and keeping their money in the bank.

Current Economic Landscape

It's fair to say that the COVID-19 pandemic has had a significant impact on both the public and private sectors, causing financial difficulties for many. Businesses have taken proactive steps to review and adjust their spending and investment plans, enabling them to adapt and thrive in these challenging times.

COVID-19 was a double whammy for companies. Not only did they have to grapple with the economic fallout of the crisis, but they also had to deal with the intensifying competition and the need to keep up with the ever-changing business landscape.

Companies had to find new ways to innovate and adapt to survive and thrive in this challenging environment.

(1)In fact, a recent survey of more than 400 business leaders by the Harvard Business Review Analytic Services found that a staggering 72% believed that digital transformation was essential to their company's survival. This underscores the importance of embracing new technologies and digital strategies to stay ahead of the competition and thrive in today's fast-paced business world.

The economic uncertainty, rapid technological changes, and limited resources make it difficult for businesses to make significant capital investments upfront.

However, asset finance has emerged as a viable alternative for businesses to acquire the assets they need to grow and succeed. We will examine why asset finance is becoming increasingly popular among companies, its benefits, and its impact on the UK economy.

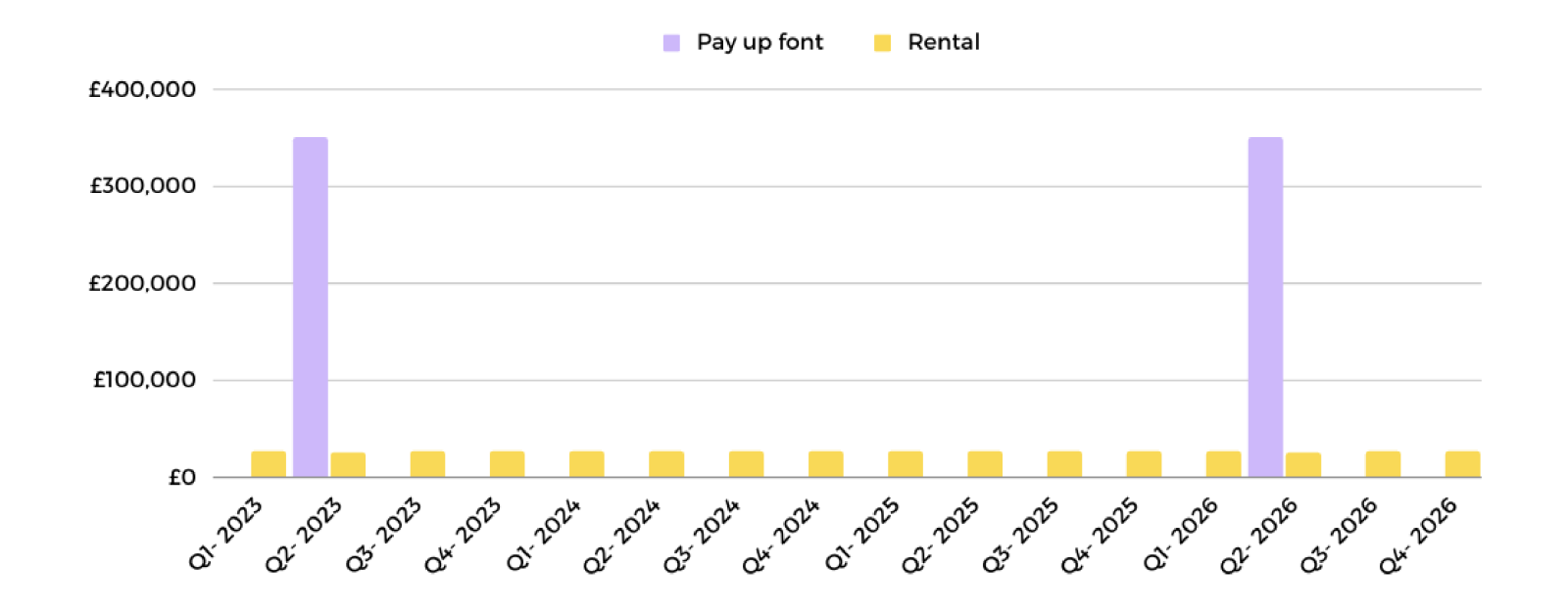

Financial Cycle: Paying upfront VS Rental

Asset Finance as a Solution?

According to a report by the Finance and Leasing Association (FLA), (2)UK businesses financed over £35 billion worth of assets through leasing and hire purchases in 2020, which was a 2% increase from the previous year (FLA, 2021).

One of the key benefits of asset finance is that it allows businesses to acquire the equipment they need without tying up capital or taking on debt. In an interview with Forbes, Mark Zandi, chief economist at Moody's Analytics, noted that "leasing can help businesses manage their balance sheets in a more efficient way. Rather than tying up large amounts of capital in equipment purchases, companies can use that money for other purposes, such as expanding their operations or hiring more employees."

Asset Finance: A Catalyst for Digital Transformation

The rapid evolution of technology has made it essential for businesses to undergo digital transformation to remain competitive. However, keeping up with the latest technology can be a significant financial strain. Asset finance provides a solution to acquire the latest technology without draining resources or causing financial strain, making it an attractive option for businesses looking to stay relevant in their market.

The Saviour Solution

As businesses continue to navigate through uncertain times an increasingly popular tool used by businesses is the cashback solution. With many companies realising the significant upfront costs associated with purchasing assets, the cashback facility has emerged as an alternative that can help alleviate the financial strain.

The cashback solution allows companies to sell their assets to a third party and immediately rent them back. Through this sale and leaseback transaction, businesses can unlock the capital value of their assets and improve their cash position. This is in contrast to a loan, which would show up on a balance sheet as a debt.

After selling their eligible assets to a finance partner, such as Econocom, companies can lease them back for an agreed period at a fixed monthly rate. This provides businesses with immediate access to funds, typically at a much more favourable rate than traditional borrowing methods.

As companies continue to face uncertain times, asset finance offers a practical solution for businesses to manage their assets efficiently, stay competitive, and thrive in the future.

At Econocom, we offer a range of solutions to help businesses acquire the assets they need without significant upfront investments. Get in touch with a member of our team to find out how our solutions can benefit your business and support its success in this recovering economy.

(1)Why Digital Transformation Is Now on the CEO's Shoulders" in the Harvard Business Review magazine in October 2017

(2)Finance and Leasing Association (FLA). (2021). Asset Finance Market Report 2021. Retrieved from https://www.fla.org.uk/wp-content/uploads/Asset-Finance-Market-Report-2021.pdf