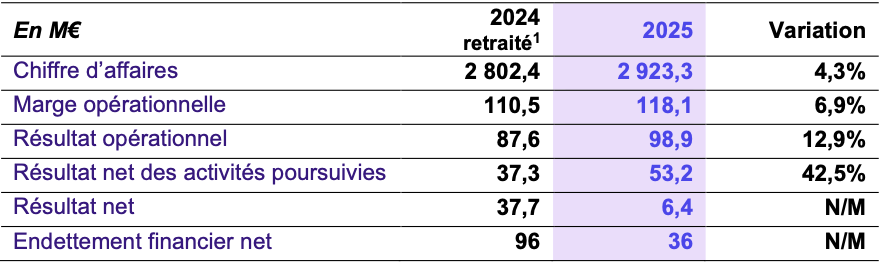

- Revenue of 2,923 million euros, up 4.3% 1 including 2.7% organic growth, driven by the strong performance of the Technology Management & Financing (TMF) and Products & Solutions (P&S) businesses and the growth of activities particularly in Southern Europe and Germany, despite an unfavorable market environment.

- Operating margin up to 118.1 million euros, representing stable profitability at 4.0% , in a context of continuous transformation of the group.

- The result from continuing operations was €53.2 million , a sharp increase (+42.5% 1 vs 2024) thanks to improved operational performance.

- Consolidated net income of 6.4 million euros , impacted by exceptional non-recurring and non-cash items related to the exit of the group's residual software publishing business to focus on its core activities.

- Reduction of net financial debt to 36 million euros by the end of December 2025.

- The strategic ambition of the One Econocom plan is maintained, but quantitative objectives for 2028 are shifted to the medium term, due to the market context, the necessary investments in AI, and continued selective external growth.

Key figures

Mr. Angel Benguigui, CEO of the Econocom Group, stated: “2025 was a significant year for Econocom in a demanding economic environment and a rapidly evolving tech market. Our results confirm the relevance of our strategic plan and model: revenue growth, increased operating margin, a strengthened sales organization, and greater synergies within the Group. In 2026, the priority is on organic growth, margin improvement, investments in AI, and cash flow generation. With the quality and commitment of our teams, I am confident in our ability to continue the high-quality execution of the 'One Econocom' plan, despite the quantitative time lag.”

Improvement in operating margin

In 2025, Econocom recorded revenues of €2,923 million, up 4.3% ¹ , including 2.7% organic growth, compared to 2024. Continuing operations saw the following developments:

- Technology Management & Financing (TMF) reports revenue of €1,127 million , benefiting from growth of 4.7% 1 , including the contribution of bb-net from January 2025. This growth, coupled with improved operational efficiency, allows for an operating margin of €60 million, compared to €47 million in 2024.

- Products & Solutions (P&S) returned to growth with revenue of €1,271 million , thanks to a strong second half. Total growth was 5.3% ¹ , driven by acquisitions of audiovisual integrators (2.9% organic growth). The operating margin was €34 million, impacted by the intense competition the group faces in defending its market position in the distribution sector.

- The Services business recorded revenue of 526 million euros , with limited growth of 1.1% 1. The operating margin remained stable at 25 million euros.

These results confirm the relevance of the group's strategy in an uncertain macroeconomic environment. The group also continues to make progress in the execution of its One Econocom plan, particularly through the following initiatives:

- Strengthening the sales force: through the agent recruitment program and the structuring of the sales offer around the four strategic verticals: Workplace, Audiovisual, Infrastructure and Financing Solutions.

- Structuring of the Econocom Audiovisual Solutions vertical: strengthened by the acquisitions of ICT, Avanzia, ISS AV and the assets of Smartcomm, the group has confirmed its position as the leading audiovisual integrator in Europe, an activity which today represents an annual turnover of more than 300 million euros and employs 750 experts.

- Continuing the transformation of the group: evolution of the organization in order to improve operational efficiency, in particular through the convergence of tools and investments in AI.

After taking into account the financial result and taxes, the net result from continuing operations amounts to 53.2 million euros.

Econocom recorded an impairment of 37 million euros on Synertrade (including €27m in the second half ), a company intended for sale, the process of which is underway as part of the refocusing on its core activities.

The net result amounts to 6.4 million euros in 2025.

Reduction of net financial debt

At the end of December 2025, the group's net financial debt amounted to 36 million euros, compared to 96 million euros at the end of December 2024. Free cash flow over the last 12 months amounted to 142 million euros.

The group has also strengthened its financial profile through a Schuldschein issue of 225 million euros in the first half of 2025, contributing to the expansion of the investor base and the financing of the One Econocom strategic plan.

A confirmed strategic ambition, but a different trajectory

Despite the economic and geopolitical context, as well as a tense Tech market, the group maintains its strategic ambition.

For the years 2026, 2027 and 2028, the group is revising its previous forecasts and is forecasting revenue growth of 2% to 3% per year, in line with market forecasts.

The priorities for 2026 for the continued execution of its One Econocom strategic plan are:

- The focus on organic growth , complemented by selective external growth.

- Continuing the transformation: increased technological investments, synergies and improved operational efficiency to increase profitability .

- Rigorous management of the group's cash flows and a disciplined approach to debt in order to preserve full strategic flexibility.

CSR: Excellent EcoVadis performance and increased contribution to the circular economy

Econocom continued to implement its ESG roadmap and improved its EcoVadis score by 2 points compared to 2024, achieving a score of 76/100 and confirming its leading position. Its subsidiary, Econocom Factory, obtained an EcoVadis sustainability score of 83/100, placing it among the top 1% of performing companies and earning it the platinum medal. These results reflect concrete commitments, particularly to the circular economy.

In 2025, the group refurbished or recycled approximately 750,000 IT devices (laptops, monitors, servers, tablets, and smartphones), thanks to the contribution of its EcoFactory refurbishment plants in France and bb-net in Germany, which actively participate in reducing the environmental footprint of digital technology. Thanks to its integrated industrial model, nearly a third of the group's assets are refurbished in its own plants, positioning Econocom as a major player in the European refurbishment market.

Shareholder remuneration

The Board of Directors will propose to the next General Meeting a repayment of the share premium of €0.05 per share. Based on the share price on December 31, 2025, this would represent a yield of 3.0%.

The repayment scheduled for July 2025 would therefore amount to €8.1 million.

Next publication: Q1 2026 revenue – April 16, 2026, after market close.

1. Restated for changes in discontinued operations.

Furthermore, Econocom has implemented a CO₂ calculator, developed in partnership with Greenly. This tool allows users to measure the carbon footprint of their activities and uses, and is fully aligned with the group's commitment to offering its clients concrete, operational solutions tailored to their specific challenges, in response to regulatory requirements and growing market expectations.